Introduced SOCSO calculation and removal of RM2000 special tax relief. On the First 5000 Next 15000.

Income Tax Malaysia 2018 Mypf My

Malaysia Annual Salary After Tax Calculator 2019.

. One of the key proposals in this years Budget is the increase in individual income tax rate highest band from 28 percent to 30 percent for resident individuals with chargeable. Tax Rates for Individual. How To Maximise Your.

The Annual Wage Calculator is updated with the latest income tax rates in Malaysia for 2019 and is a great calculator for working out your. Rates Real Property Gains Tax Stamp Duty Sales Tax Service Tax Other Duties Important Filing Furnishing Date. On first RM600000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia. Based on this amount the income tax to pay the government is RM1640 at a rate of 8. Tax Booklet Income Tax.

An effective petroleum income tax rate of 25. The Corporate Tax Rate in Canada stands at 2650 percent. Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income.

Update of PCB calculator for YA2017. Statutory Corporate Income Tax Rates. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income.

The Inland Revenue Board explicitly shows the income tax rates for the current assessment year YA while weve also shown a comparison between the tax rates for YA. Introduced bonus feature as an additional income. RM65850 You can calculate your taxes based on the formula above and just make sure your total income in the first column comes up to your total.

On the First 5000. Petroleum income tax Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person.

An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia. Budget 2019 introduced new tax rates. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. This covers the tax relief import duty personal income tax life insurance EPF SSPN property rebates and more. 20182019 Malaysian Tax Booklet 7 Scope of.

Country 112 112 Corporate income tax rate 6 6 Year 22 Layout. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income. Calculations RM Rate TaxRM A.

Everything You Need To Know About Running Payroll In Malaysia

Gst In Malaysia Will It Return After Being Abolished In 2018

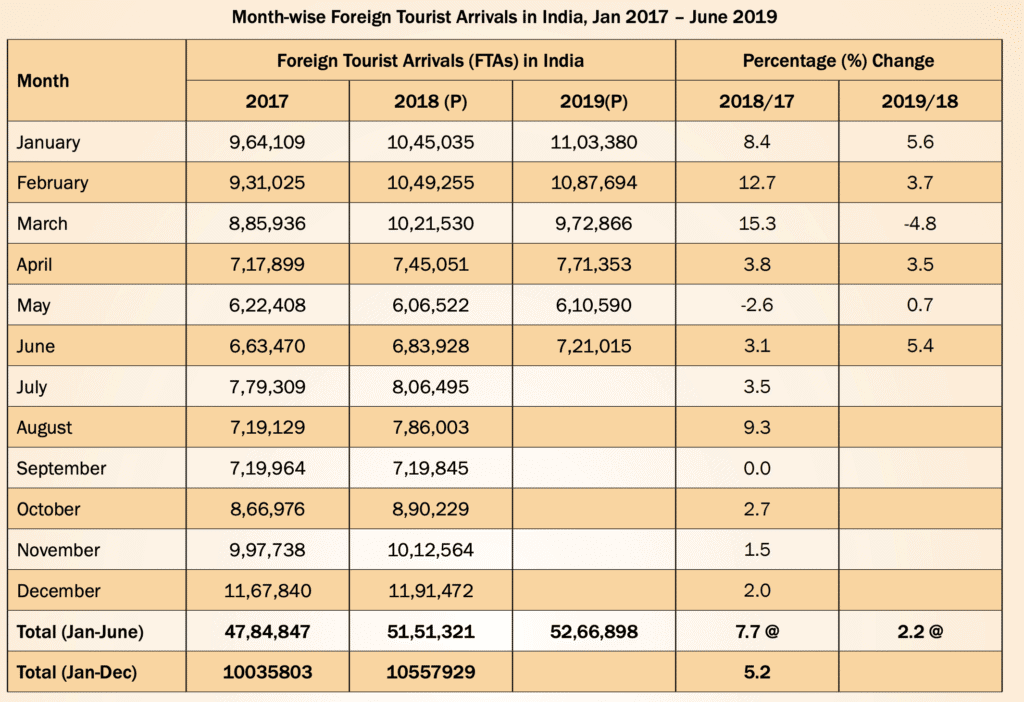

India Tourism Statistics 2019 Get Complete Information

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Individual Income Tax In Malaysia For Expatriates

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Income Tax Formula Excel University

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Do You Need To File A Tax Return In 2019

Belize Gdp Per Capita 2022 Data 2023 Forecast 1960 2021 Historical Chart

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia